Futures Market: Overnight, the most-traded ag2509 futures contract for alumina opened at 2,895 yuan/mt, with a high of 2,908 yuan/mt, a low of 2,870 yuan/mt, and closed at 2,890 yuan/mt, down 7 yuan/mt or 0.25%, with an open interest of 303,000 lots.

Ore: As of June 19, the SMM Import Bauxite Index was reported at $74.43/mt, up $0.06/mt from the previous trading day. The SMM Guinea Bauxite CIF average price was reported at $74.5/mt, unchanged from the previous trading day. The SMM Australia Low-Temperature Bauxite CIF average price was reported at $70/mt, unchanged from the previous trading day. The SMM Australia High-Temperature Bauxite CIF average price was reported at $65/mt, unchanged from the previous trading day.

Industry News:

- Alumina Weekly Production Update: According to SMM data, as of Thursday this week, the total installed capacity of metallurgical-grade alumina in China was 110.82 million mt/year, with a total operating capacity of 88.57 million mt/year. The national alumina weekly operating rate decreased by 0.4 percentage points WoW to 79.92%, mainly due to production cuts by some enterprises considering ore costs.

- Alumina Port Inventory: According to SMM statistics on June 19, the total alumina inventory at domestic ports was 37,000 mt, a decrease of 1,200 mt from the previous week.

Basis Report: According to SMM data, on June 19, the SMM Alumina Index had a premium of 310.87 yuan/mt against the latest transaction price of the most-traded contract at 11:30.

Warrant Report: On June 19, the total registered alumina warrants decreased by 11,087 mt from the previous trading day to 49,200 mt. In the Shandong region, the total registered alumina warrants decreased by 601 mt from the previous trading day to 0. In the Henan region, the total registered alumina warrants decreased by 300 mt from the previous trading day to 0. In the Guangxi region, the total registered alumina warrants remained unchanged from the previous trading day at 3,001 mt. In the Gansu region, the total registered alumina warrants remained unchanged from the previous trading day at 0. In the Xinjiang region, the total registered alumina warrants decreased by 10,186 mt from the previous trading day to 46,200 mt.

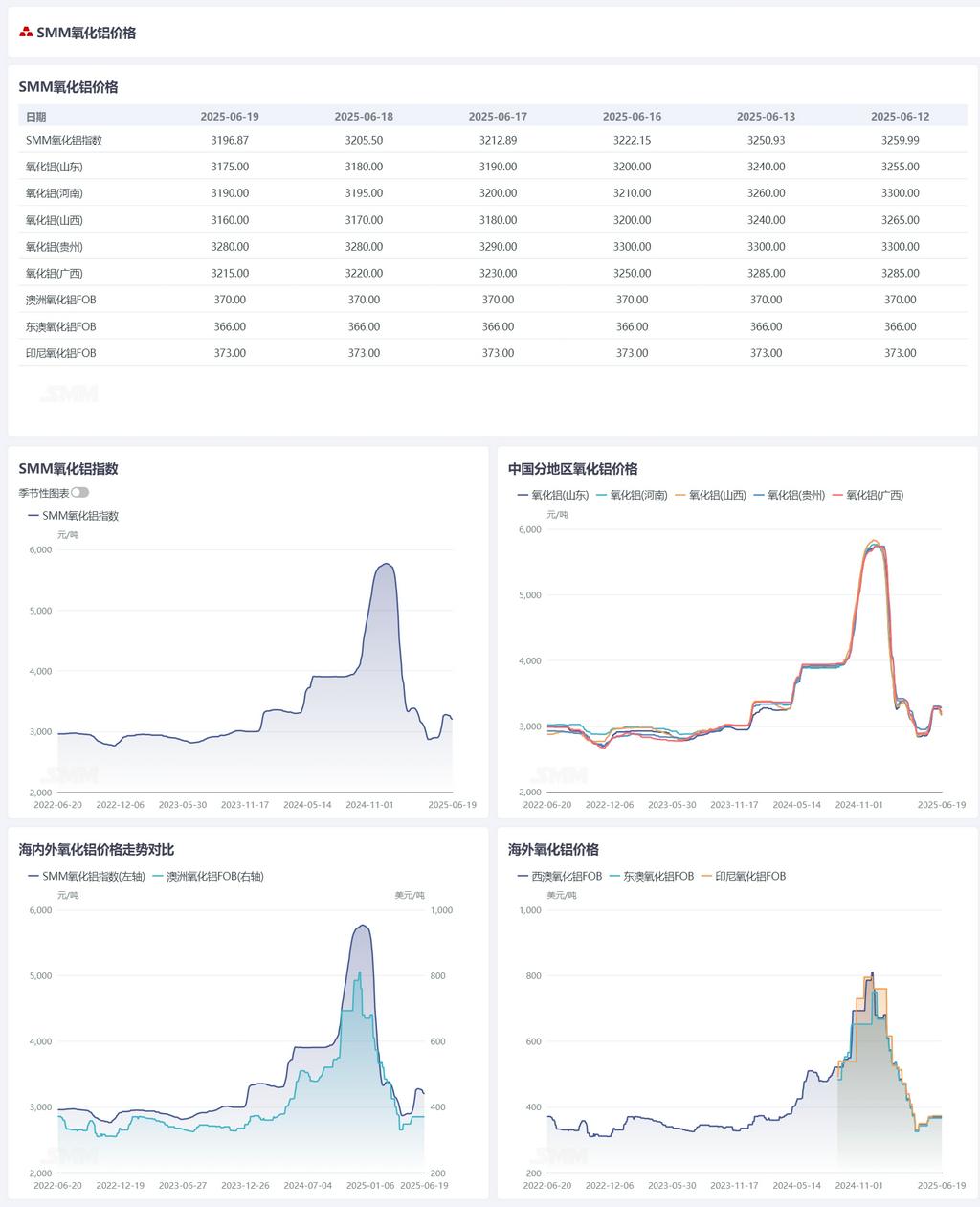

Overseas Market: As of June 19, 2025, the FOB Western Australia alumina price was $370/mt, with an ocean freight rate of $22.60/mt. The USD/CNY selling rate was around 7.21. This price translates to an approximate external selling price of 3,278 yuan/mt at major domestic ports, which is 81 yuan/mt higher than the domestic alumina price. The alumina import window remained closed.

Summary: This week, some alumina refineries completed maintenance and resumed production. Meanwhile, new production cut news emerged due to ore cost considerations, leading to a parallel increase and decrease in alumina operating capacity. Overall, the alumina operating capacity decreased by 440,000 mt/year MoM to 88.57 million mt/year. Spot alumina supply remained loose. This week, the total alumina inventory at aluminum smelters increased by 8,600 mt to 2.655 million mt. In the short term, the alumina market fundamentals are expected to maintain a relatively loose pattern, and spot alumina prices are expected to drop back slightly. Subsequently, continuous attention should be paid to the changes in the capacity of domestic alumina enterprises, as well as their profitability.

[The information provided is for reference only. This article does not constitute direct advice for investment research decisions. Clients should make cautious decisions and should not rely on this to replace their own independent judgment. Any decisions made by clients are unrelated to SMM.]